Motor Trade Industry Insurance

Helping the motor trade industry prepare for the future

Travelers offers motor trade industry insurance designed to cover everyday risks and help to mitigate their impact whilst keeping up with continuous innovation in an evolving market. Travelers can help design the roadmap you need to be supported along your journey.

Our experienced team knows the motor trade industry inside and out. We offer specialist property, liability and motor cover, helping your business anticipate key risks and protect against incidents. As a result, you’ll be able to place less focus on what might happen, and more on driving business growth in the years to come.

Explore motor trade subsectors

SME motor trade

For motor trade businesses involving commercial and private vehicles, we’ve developed bespoke solutions in a combined package including specialist property, liability and road risks covers.

Mid-market & corporate motor trade

Thanks to our extensive history in the industry, we bring comprehensive offerings and claims services – including large loss expertise – to our motor trade covers.

Motor trade road risk for SMEs

Simple yet flexible road risk only cover for SME motor trade businesses involved in vehicle sales, mechanical repairs, servicing and repairs. Available to trade online.

Policyholder benefit

Cardinus Risk Management

Customers have free access to Cardinus Risk Management, a computer-based training system covering a multitude of health and safety issues. Further licenses can be purchased at a discounted rate.

Access to Cardinus Risk Management courses at no additional cost.

Hundreds of online courses available to help manage the many risks that modern businesses face including safe driving for road risks exposure.

Travelers advantage

In the evolving motor trade industry, things don’t always go to plan. Travelers offers expertise you can count on to address diverse risks thanks to a detailed and bespoke underwriting process that can help small to medium enterprises (SMEs) as well as larger mid-market and corporate risks.

- Financial strength. Financial strength and stability with international reach.

- Experience & expertise. Long-term industry experience combined with deep specialist underwriting expertise.

- Superior claims service. Expert Claims teams focused on delivering superior service.

- Dedicated risk managers & consultants. Access to risk consulting from trusted experts.

- Rehabilitation. Aid injured employees return to work with Travelers Proactive Rehabilitation Support.

- Safety Academy. Access to Institute of Occupational Safety and Health Managing Safety classroom courses.

- Windscreen repair/replacement. Access to windscreen repair and replacement services.

Windscreen repair partner providers

Mr. Windscreens

Mr. Windscreens can be contacted directly by Travelers customers.

By phone: +353 (0)818 5 12345

Online: customers will need to provide information validating the policy cover.

Autoglass

Customers wishing to use Autoglass for glass repairs or replacement can call the following number.

By phone: +353 (0)1 409 0900

Online: customers can schedule an appointment now. The vehicle registration number will be needed to match repair materials with the exact make and model of the vehicle.

Let’s start the right conversation

For business

Find a broker

If you’re looking for covers and have a broker, ask about Travelers products.

If you need a broker, start with the right broker directory.

Need to call us directly? Contact us.

Legal changes

Driver licence number requirements

Enacted 31 March 2025, anyone buying or renewing their motor insurance in Ireland must provide the Driver Number for any named drivers on their policy.

Related services

Risk services

Businesses aren’t all alike. That’s why Travelers provides superior risk management services tailored to a company’s specific needs.

Claims services

When claims happen, our best-in-class service helps to resolve them quickly and effectively, so clients can get back to business.

Insights & industry knowledge

Articles to help your ambition succeed

Cyber Security Resources

Travelers Helps Clients Protect Against Evolving Cyber Threats

The wealth of opportunities for cyber attacks have transformed malware into an industry in its own right – albeit an illegal one – that continues to grow in sophistication.

Risk Management Resources

Business Continuity Planning

Having a thorough plan can ensure that even when things go wrong, businesses can operate without interruption.

Risk Management Resources

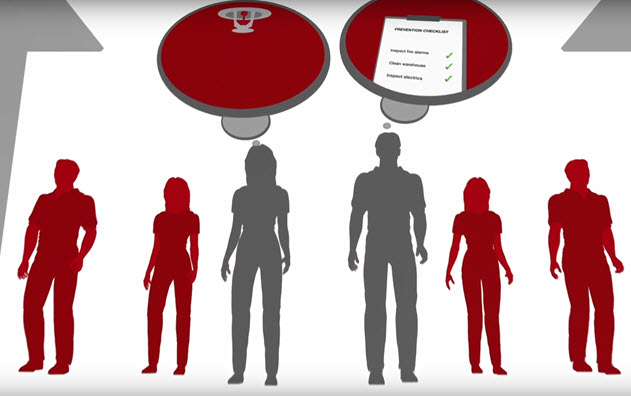

Prevent Crime, Vandalism & Arson

Advice on how to prevent crime, vandalism and arson.

Brokers, sign up for our newsletter to stay ahead of the curve

Follow us on LinkedIn for our latest market insights.