Surety Bonds for Businesses

Many public and private contracts need an extra layer of protection – like a bond or guarantee – to ensure the job will get done as promised. For over 100 years, our surety business has provided this security, helping clients build trust and deliver with confidence.

We offer a powerful combination of personal service, financial stability and expertise. Our team serves clients from local offices and has the backing of a parent company that is one of the largest writers of surety premium in the US – the world’s biggest surety market. Our strong financial ratings and depth of experience in banking and law give clients a clear advantage in navigating complex requirements.

Travelers Surety covers two core lines, Construction/Contract and Commercial Surety, and serves a wide range of industries and project types.

Our appetite

We cover

These fall within our appetite, and we’re happy to discuss details.

![]() Commercial Surety Bonds

Commercial Surety Bonds

All blue-chip / strong risk-profiled clients across many bond types in the non-construction sectors with a minimum bond requirement of €30m.

![]() Contract Surety Bonds

Contract Surety Bonds

Tier 1 major international contractors and UK / Ireland large and mid-market contractors providing facilities from €15m.

Travelers advantage

- Financial strength. Financial strength and stability with international reach.

- Experience & expertise. Long-term industry experience combined with deep specialist underwriting expertise.

- Superior claims service. Expert and dedicated Surety Claims teams focused on delivering superior service.

Advantage spotlight

Travelers offers local service backed by global strength

At Travelers, our clients get more than financial backing – they gain a partner who understands their business, supports their goals, and can deliver targeted expertise. That’s possible through the one-to-one service we offer through local offices, paired with the strength of our parent company – one of the largest writers of surety premium in the US. We pride ourselves on our personal approach, knowledge of contract and commercial bonds, and worldwide reach.

A personal approach

At the core of our surety business is a personal, service-driven model. Through our local offices, we connect with our clients and take time to understand their needs. This hands-on support helps clients move forward with confidence. Our goal is to help clients build stronger, more resilient businesses. We succeed when our clients succeed.

Expertise in contract bonds

We specialise in supporting the construction industry and we have deep sector knowledge and long-standing relationships here – our average contract bond client has been with us for 17 years. We have 50+ offices across the UK, US and Canada, and a dedicated claims team of 77 specialists. This structure allows us to provide responsive, local support wherever our clients’ work is happening. From bid to final completion, we’re with our clients every step of the way.

Commercial bonds with global support

The Travelers Commercial Surety team supports businesses ranging from large, mid-tier businesses to multinational companies. Our local experts deliver tailored solutions backed by international capabilities. We have a presence in Canada, Brazil, Colombia and the UK. We also have regional offices in 16 US locations and 50+ field offices staffed with Surety specialists who can assist with local filing requirements. These teams, along with our capabilities to place bonds beyond those regions, allow us to conduct business in more than 65 countries seamlessly and efficiently.

Protections:

- Performance bonds

- Safeguarding bonds

- Retention bonds

- Deductible guarantees

- Pension bonds

- Payment bonds

Client support:

- Dedicated commercial surety claim counsel

- Legal counsel services including bond form creation and contract review

- Risk mitigation seminars

- Centres of Excellence for sharing knowledge

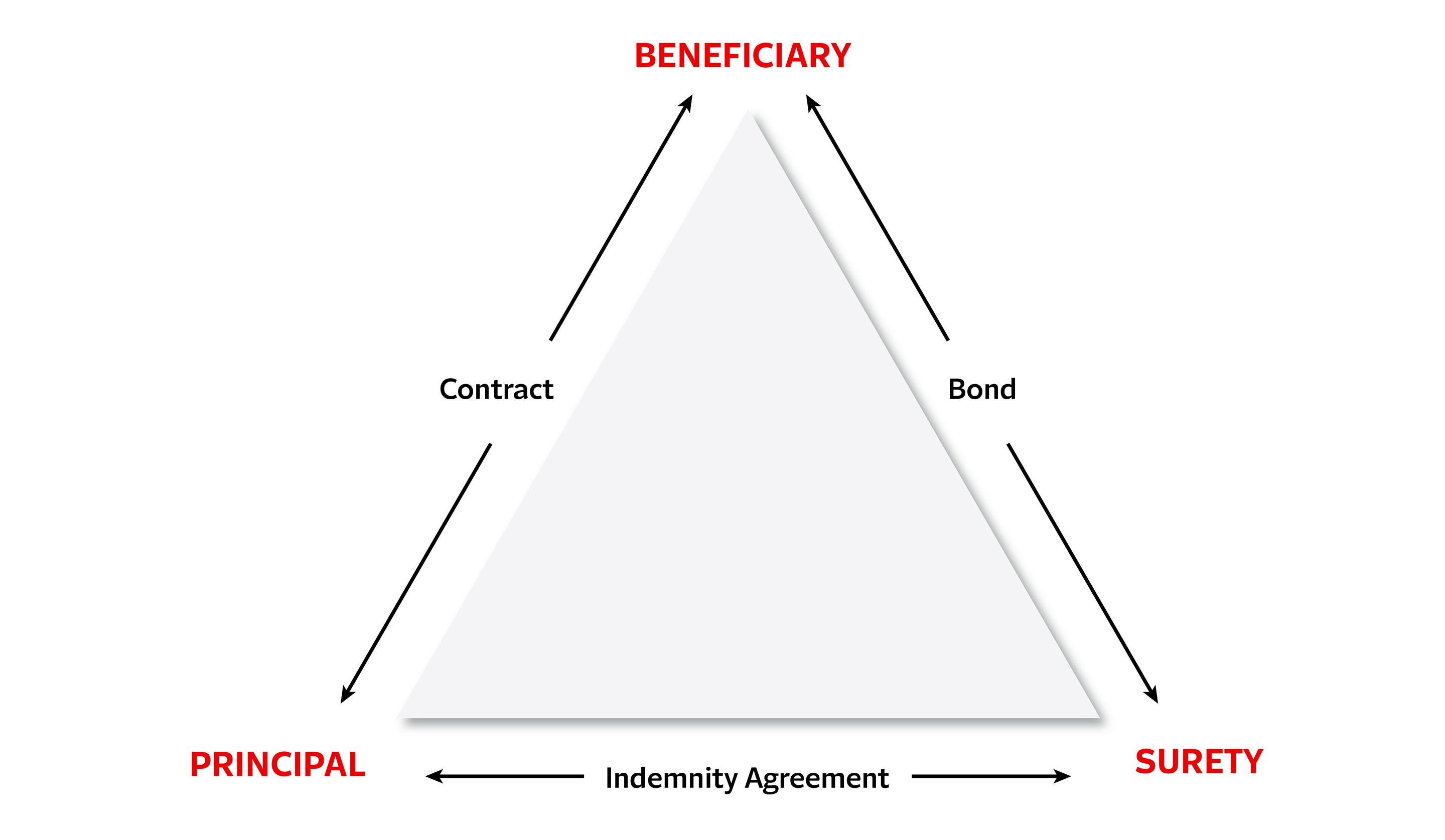

Understanding the three parties in a surety contract

Surety contracts operate differently from insurance contracts. Instead of including just two entities – the insurance provider and policyholder – surety bonds involve three parties: the principal, the obligee and the surety. Learn more about the roles and responsibilities of these parties, and how they function in an example of a surety contract.

Equilateral triangle with text on each side and on each angle that illustrates the three parties involved in a surety bond and how they work with each other. Top angle reads Beneficiary. Bottom left angle reads Principle. Bottom right angle reads Surety. The text on each side of the triangle is sandwiched between outward arrows that point to the text labeling the connecting angles. Left side reads Contract that points to Beneficiary and Principal. Bottom side reads Indemnity Agreement and points to Principal and Surety. Right side reads Bond and points to Beneficiary and Surety.

Business questions

Our parent company has a US$2.8 billion combined Treasury limit and AA rating from S&P Global. Our European operations also have an AA rating from S&P Global. Corporations and banks across the globe trust in our financial strength.

Yes, we provide tailored solutions for construction and commercial industries, then support them with an experienced international team focused on customer needs and responsive service.

We have built a track record of reliability and excellence over more than 100 years in the surety business. We specialise in building tailored solutions that meet clients’ unique needs.

The Travelers Surety team serves businesses ranging from large, mid-tier businesses to multinational companies. These businesses often have complex needs that require tailored protection.

The team can utilise a trusted network of co-surety partners in order to effectively spread risk of this type, opening up growth opportunities for our clients.

As a first step we need to see the latest financial statements of the client, plus the proposed bond wording and related/underlying contract or agreement.

Our local presence in the US, Canada, Brazil, Colombia, Ireland and the UK, along with capabilities to place bonds beyond those regions, allow us to conduct business in more than 65 countries.

Related products

Cyber

Every company faces cyber threats and risks. Cyber cover helps businesses deal with the increasing complexity of digital crime.

Management liability

When losses and lawsuits pose professional and personal risks to a company’s leaders, management liability insurance can help them stay focused on running the business.

Financial institutions

Fully invested and without compromise, our dedicated underwriters have deep knowledge of the financial sector with the backing of a strong credit rating.

Let’s start the right conversation

Insights & industry knowledge

Articles to help your ambition succeed

Insurance Industry News

Travelers Celebrates 30 Years in Ireland

Travelers marks 30 years in Ireland, celebrating milestones like $250M GWP, 60+ employees, and global expansion through TIDAC.

Cyber Security Resources

Why Choose Travelers? Cyber Insurance Success Stories

With cyber threats evolving in sophistication every day, Travelers has met the need of the changing market with a growing client base and threat intelligence.

Brokers, sign up for our newsletter to stay ahead of the curve

Follow us on LinkedIn for our latest market insights.